About Us

Our Mission

Our Vision

Where you do your banking matters.

At St. Louis Community Credit Union (SLCCU), everyone belongs. We believe banking is a public good for all to enjoy. And while not all people begin their financial journey at the same starting point or have the same advantages, we strive to create options and opportunities for everyone.

For many of the people we serve, that sense of belonging is what helps them to navigate difficult financial situations, as well as seize opportunities that can build lasting wealth for them and their family. Belonging is especially important as our region and nation recons with the historic impacts of the racial wealth divide.

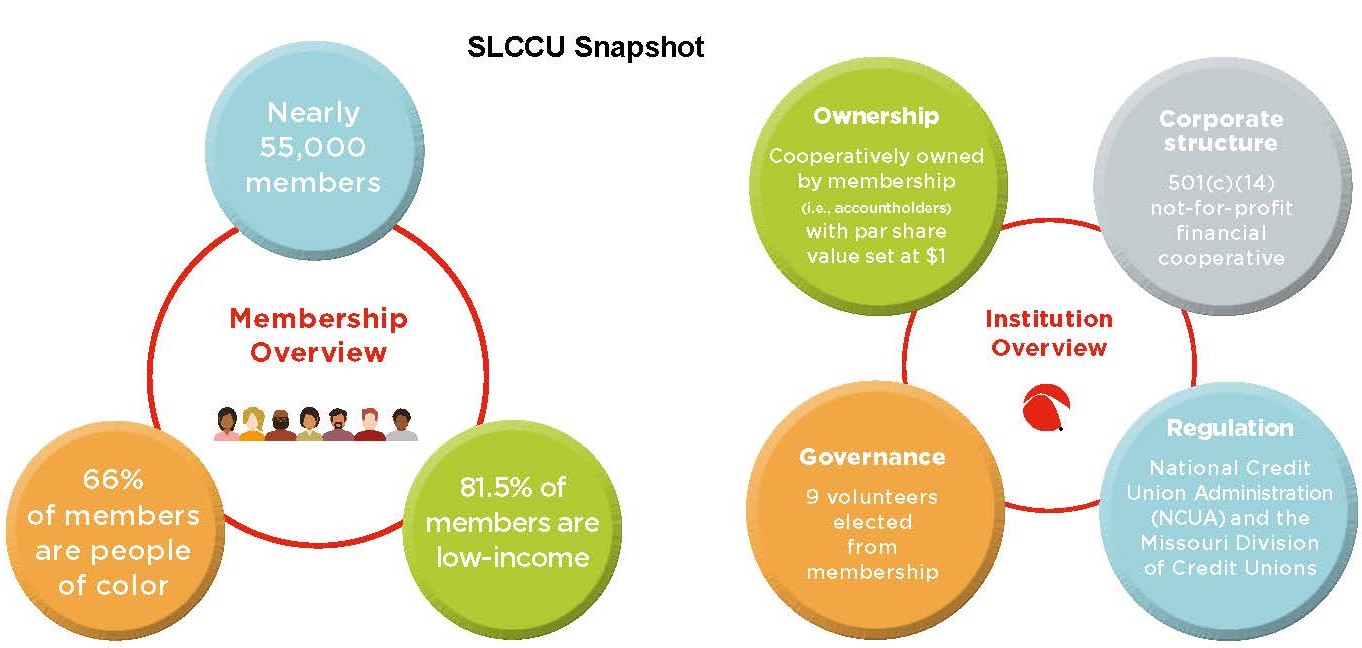

As a not-for-profit financial cooperative, SLCCU is owned by our nearly 55,000 members -- the majority of whom are African American. While we did not seek to become one of the nation’s largest Minority Depository Institutions (MDIs)*, the needs of our community and the credit union’s willingness to serve has made it so. We lead with financial inclusion. That’s why we understand and recognize that when everyone has an equal opportunity to live out their best financial lives, all of us are stronger.

Eliminating the racial wealth divide will require a concerted effort from public, private and philanthropic sources. For our part, SLCCU seeks engagement with a wide range of people and organizations who believe in our mission and who are able to support it through their deposits and other forms of investment.

SLCCU serves residents of St. Louis City and those of Franklin, St. Louis and St. Charles counties in Missouri; as well as St. Clair, Madison, Monroe and Jersey counties in Illinois. With all of the conveniences of a big financial institution, but with the heart of a locally-owned credit union, we have your back. For eight decades, we have fostered an inclusive approach to banking where all are welcome and have access to tools to help them thrive. No matter where you are in life, let us help you find your possible.

- Affordable personal, auto, business, credit building and home loans

- Savings, checking and money market accounts to meet your needs

- Convenient online, mobile banking and branch locations

Become part of the solution.

By starting a banking relationship with SLCCU, you can help us build a more financially inclusive region for all!

Account Services

Loans

Community Impact Deposit

Helpful Resources

Financial inclusion matters to us. Below are helpful resources that can help educate others on the importance of ensuring that everyone belongs.

BOARD OF DIRECTORS

Angela Franks, Chair

Kamarrah Killion, Vice Chair

Steven Wood, Secretary/Treasurer

Gerald Brooks

Tim Butler

Susan Katzman

Tom Sullivan

John Windom

SUPERVISORY COMMITTEE

Holly Humfeld, Chair

Patricia Adams

Steven Wood

Rena Faulkner