Community Impact Deposit

Financial access is a right, not a privilege. Sadly, many people across our region are unable to qualify for basic banking and loan services because they have a poor credit rating, an inability to meet minimum account balance requirements and more. This lack of financial access makes it harder to save for the future, purchase assets like a car, home or business, and stops families from building generational wealth. In short, our financial system has become a place where some people belong, and others do not.

At St. Louis Community Credit Union, we believe everyone should have access to pathways that help them strengthen their financial future and achieve their dreams. And while we have eight decades of providing inclusive service to financially vulnerable communities, we cannot do this work alone. We all have a role to play in building a financially equitable society for everyone.

Where do you fit in?

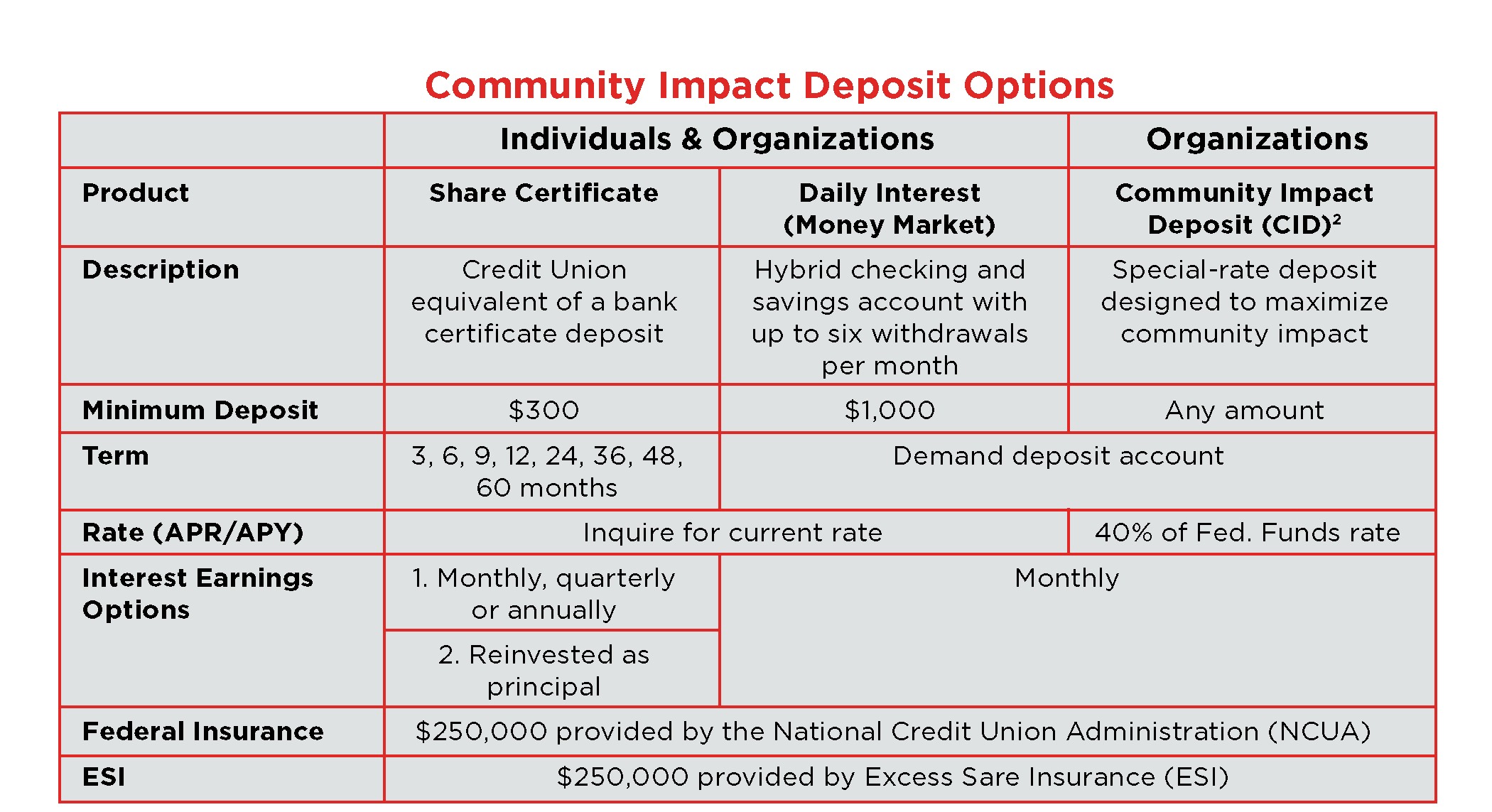

Start a deposit relationship with us by opening a traditional savings, checking, money market or certificate of deposit account. Your federally insured deposits1 help finance automobiles for people in need of personal transportation to access a higher paying job. They fund loans for first-time homebuyers. And they give diverse entrepreneurs the ability to make their business a reality and contribute to the success of the regional economy.

St. Louis Community Credit Union has the experience, staff and passion to make banking more accessible and meaningful in the lives of people and families who deserve to belong.

Join us in building a more financially inclusive and successful region.

For more information regarding these savings options, contact us.

1All deposits insured up to $250,000 by the National Credit Union Administration (NCUA). 2CID product only available to organizations and institutions.